The SPY looks primed to open lower post long weekend. The price action on WATT Friday looked like someone was accumulating shares and given the recent news, I wouldn’t be shocked if the company announced more good news this week.

Lakeland Industries, Inc (NASDAQ:LAKE) is on watch on reports that 200 people have been infected by a new coronavirus outbreak. Chinese government officials have said it can be spread human to human. My initial buy zone would be above $10.70 with a goal of $12-$13 for profit though it certainly could open up a lot higher. Earnings aren’t until March 9 which is plenty of time to see if this gets some momentum.

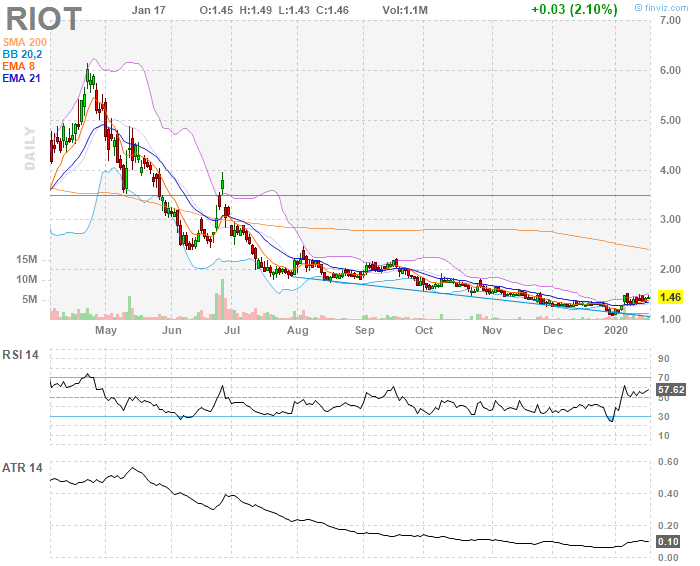

Bitcoin truly appears to be back and this could be the start of a big run again I think. The initial hype from a few years ago has faded and cryptocurrency is still here, growing and likely to gain momentum again in 2020. Riot Blockchain Inc (NASDAQ:RIOT) is such a horrible looking chart but at these levels I could see it running again if bitcoin makes a big move anytime soon. Buy zone here is above $1.30 so that’s the stop loss area with a goal of 10-20% but maybe a rip to $2 as well.

Retail is not a space I like to trade but breakdowns are and this one has a history of big moves after big drops so I’m watching close. Markets are down today so it’ll be really important to pay attention to divergence. If Pier 1 Imports Inc (NYSE:PIR) doesn’t go lower when the market does, that’ll be a good sign the $3.40’s are short-term bottom I can play off of. However, the rolling action late last week leaves me skeptical it’ll hold. Should it fail, even better because upside opportunity will increase.