Investors have regained interest in the tech sector, which was one of the worst-performing sectors in 2022. The tech-heavy Nasdaq Composite has been the top-performing Wall Street index this year, having gained approximately 14.5% since the beginning of the year.

The recent surge in optimism about technology has been fueled largely by the hype surrounding artificial intelligence. The widespread success of ChatGPT, an AI chatbot developed by Microsoft-backed OpenAI, has revived enthusiasm for tech stocks following the well-documented struggles of the metaverse.

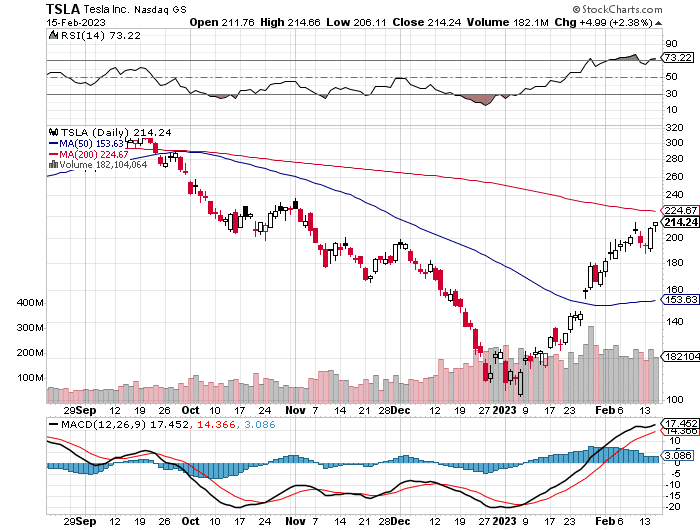

Despite the positive sentiment, some investors remain cautious about the tech rally. So where is TSLA headed next ? Let’s compare it to TSLA to get an insight if TSLA stock is cheap the current levels.

On Wednesday, Charlie Munger stated that his preferred stock of all time is BYD, a Chinese electric vehicle manufacturer, adding that Tesla falls short in comparison. Berkshire made a profitable investment in BYD when it acquired around 220 million shares in September 2008. Over the last decade, the stock has surged by over 600% due to the rapid expansion of electric vehicles, leading to substantial gains for the company. However, as the stock’s value continues to rise, Berkshire has been gradually reducing its stake in BYD over the past year. BYD recently said it expects record adjusted annual profit for 2022 of 16.3 billion yuan ($2.4 billion), about 1,200% above 2021.

Tesla and BYD both had a rough year in 2022, but both companies have seen a resurgence in the stock market at the start of the new year.

As leaders in the electric vehicle industry, they are surpassing their competitors in terms of EV production. Both companies have been expanding rapidly with robust profits, although there may be greater divergence in 2023.

Some of other notable stocks include Airbnb, which outperformed earnings and revenue estimates for Q4 and climbed over 13%. On the other hand, Devon Energy’s shares slumped by 10% the day after the company failed to meet earnings expectations.It’s worth noting that Jim Cramer’s Charitable Trust portfolio holds Devon Energy.