Summit Therapeutics Inc (NASDQ:SMMT) last traded on Friday at $3.61. The recent surge is attributed to news that it’s licensing bispecific antibody ivonescimab from Chinese drugmaker Akeso. Akeso will retain the rights to market the therapy throughout the rest of the world, including China. Is there more room to surge ?

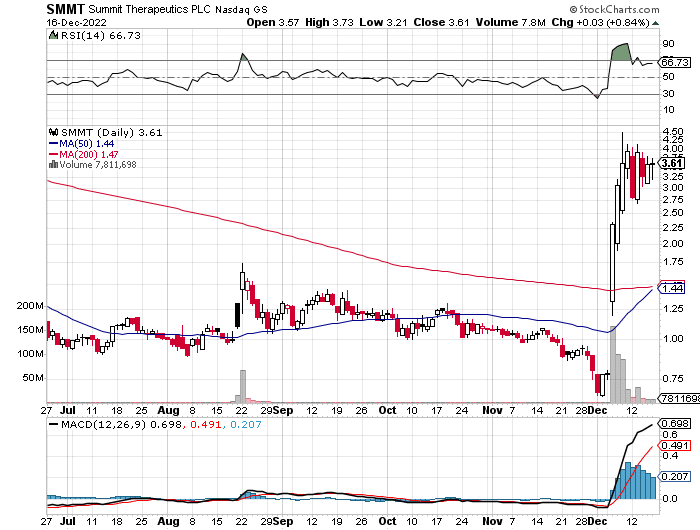

Lets take a look at technical stock analysis for SMMT

$4 is the resistance on the chart for SMMT with $3 is the support. For a technical trader it could be important for SMMT stock price at $3.30’s hold up and price action above $4 to signal it’s headed for $5. Their cash need is medium with 20.8 months of cash left based on quarterly cash burn of -$15.59M and estimated current cash of $108.1M. What’s interesting is individual insiders own the lion’s share with 84% ownership of the company. Shares surged as a result of a monster licensing agreement for a cancer program with Akeso in a deal for up to $5B. Historical dilution is high and their offering ability is high, leaving the overall risk medium according to Dilution Tracker.

It would be interesting to see if bulls decide to five in and give shorts the offering they are looking for or if the shorts get trapped and SMMT goes to $5-$6 soon, which the price action is strongly suggesting. Overall range is to $8 and as the stock showed us recently, it can move up a buck at a time pretty quickly.